METAVILLE

An exciting virtual savings platform

Title: Future of financial services

Type of Work: Industry live brief | 5 member team project

PROJECT OVERVIEW

Client: Capco

About: Metaville is a virtual world and financial management platform which motivates users to develop good saving habits with a tangible, engaging and social saving experience.

My role: User research, UX design, Pitch presenter, Brand design.

Extent of project: May - July 2022 | 8 weeks

Deliverables: Storyboard, Service blueprint, Mid fidelity prototype renders.

Capco is a global technology and business consultancy focused on the financial services sector. They operate at the intersection of business and technology by combining innovative thinking with unrivalled industry knowledge to deliver end-to-end data-driven solutions and fast-track digital initiatives for banking and payments, capital markets, wealth and asset management, insurance, and the energy sector.

BRIEF

As our digital and physical worlds become ever more intertwined, how might we bring a fresh and informed perspective on the future of financial services to provide new experiences that anticipates and meet customers' needs in these new digital spaces?

33%

of young adults are worried they’ll never own a property, or even start a family in the future.

(Paypal UK, 2022)

32

is the average age of a first-time buyer.

(National Statistics UK, 2021)

23%

of Gen Z's money is spent on dining out and online subscriptions.

(Thunes Report, 2022)

RESEARCH FOCUS

We are going to research the current financial behaviours with Gen Z young professionals who expect to reach their goals in life, so that we can design an appropriate and innovative solution which can help them save and make money in financial services.

PROCESS

IDENTIFY

AssumptionsSecondary researchPrimary researchDEFINE

Target user groupKey insightsPersonaDEVELOP

BodystormingService blueprintKey featuresDELIVER

StoryboardConcept imagesFuture developmentSECONDARY RESEARCH

We brainstormed possible target group and areas to focus on which included Gen Z and money problems, Millennials and financial progression, Baby boomers and modern banking. Gen Z and Millennials were chosen due to ease of access to participants. Assumptions were made about these group using 5Ws and 1H method. The next question is how accurate are our assumptions and how can we prove or disprove this?

ASSUMPTIONS - 5Ws 1H

Who?

18-25 year old working professionals. (Gen Z)Where?

in their homes, social spaces.What?

Managing money online, spending frequently to fulfil social needs.Why?

Lack of adequate financial literacy, want to keep up with their peers.When?

Daily, weekly.How?

Using digital products such as phone, tablets, laptops.To get more insight into our assumptions, identify key pain points and specify a design area, we did some secondary research surrounding the following questions:

EXISTING RESEARCH

What are Gen Z’s currently doing / implementing for their finances?What is the psychology behind why people do things in relation to their finances?What are banks currently doing for customers needs? (Web 3.0 and traditional)What are the pain points and key user needs of our target users?What are the projected future technologies business/banks are looking to implement?Inflation has led to an increase in the price of essentials, making it harder for Gen Z to save as much as they would like.

Young adults recognises being organised and planning their spending are important aspects of managing money but felt that this often inhibits their social life.

The conservative financial institutions may step up in the issuance of central bank digital currencies.

The next logical step in the digital customer experience could be serving customers in virtual realms.

Gen Zers patronize financial institutions and invest in companies that mirror their goals for sustainability, social justice, and other causes they deem important.

FINDINGS

PRIMARY RESEARCH

We interviewed with 5 young professionals to learn more about their current financial management, attitudes towards investments, WEB 3.0 and also to identify possible current problems. Doing this enabled us to narrow down our design focus.

INTERVIEWS

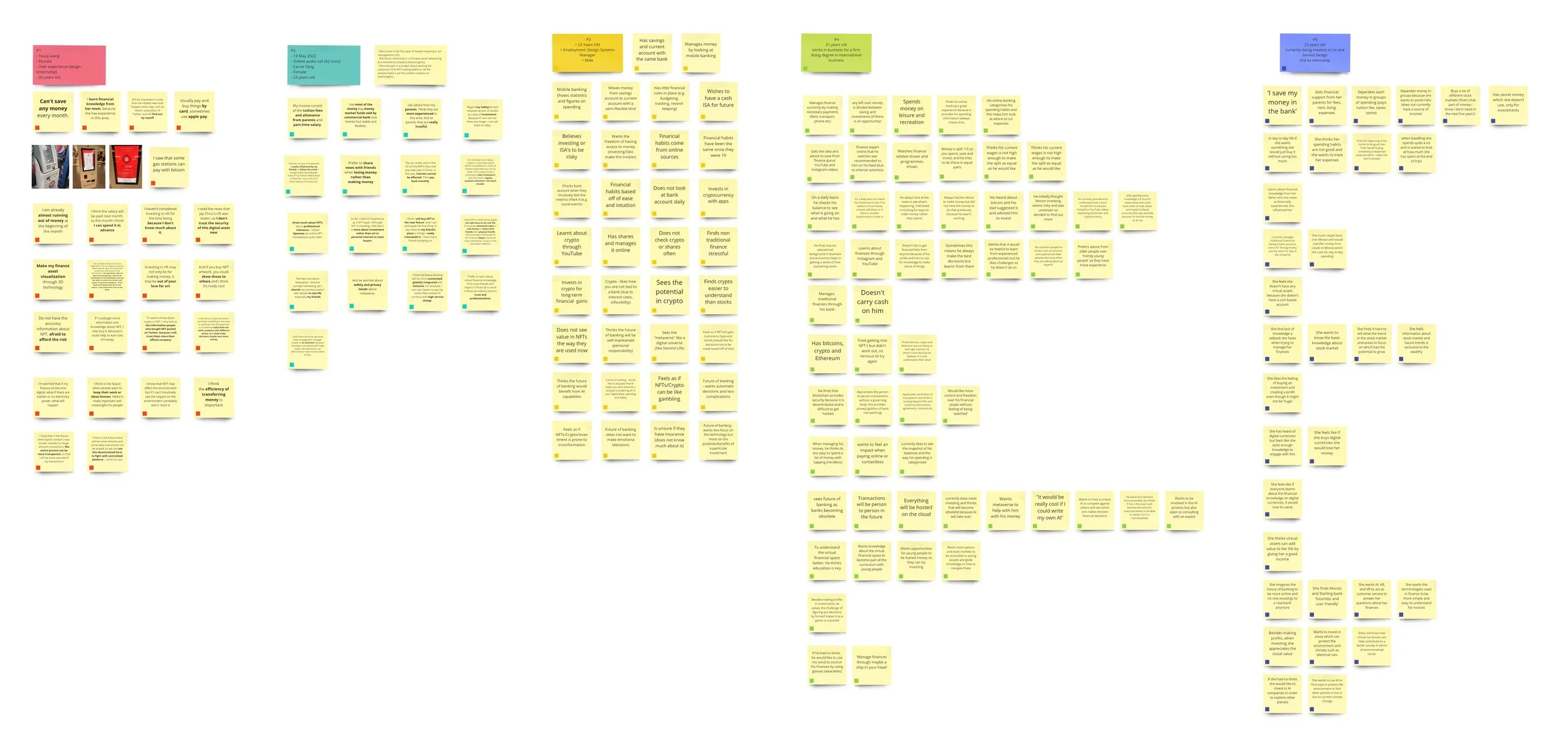

Affinity diagramming helped us find patterns and themes derived from interviews, we gathered the insights and voted on the most desirable for our users and the business using a matrix.

AFFINITY DIAGRAMMING

We used card sorting with 7 participants to identify users' saving goals, both long-term and short-term, and confirm whether daily activities conflict with their saving goals.

CARD SORTING

There exists a conflict between daily spending and their long-term savings goals, with users highly likely to spend subconsciously in their daily lives, which prevents them from their savings expectations. The top 2 saving goals both long-term and short-term were :

FINDINGS

Long-term

Financial security

Home ownership

Short-term

Food/drinks

Entertainment

REVISED OPPORTUNITY

There is an opportunity to design an innovative solution for young professionals in the first few years of their career, who want to own first home but struggle with micro impulse purchases (e.g. food, in-app) , so that they can save money and put their goals into practice.

KEY INSIGHTS

1

Priority long-term goals include seeking financial stability and owning a home.2

Willing to invest for the feeling of reward but struggle with micro-purchasing.3

Micro-purchases are impulsive, justified by emotions.4

Micro-purchases seem inconsequential due to a lack of accountability (e.g. contactless)5

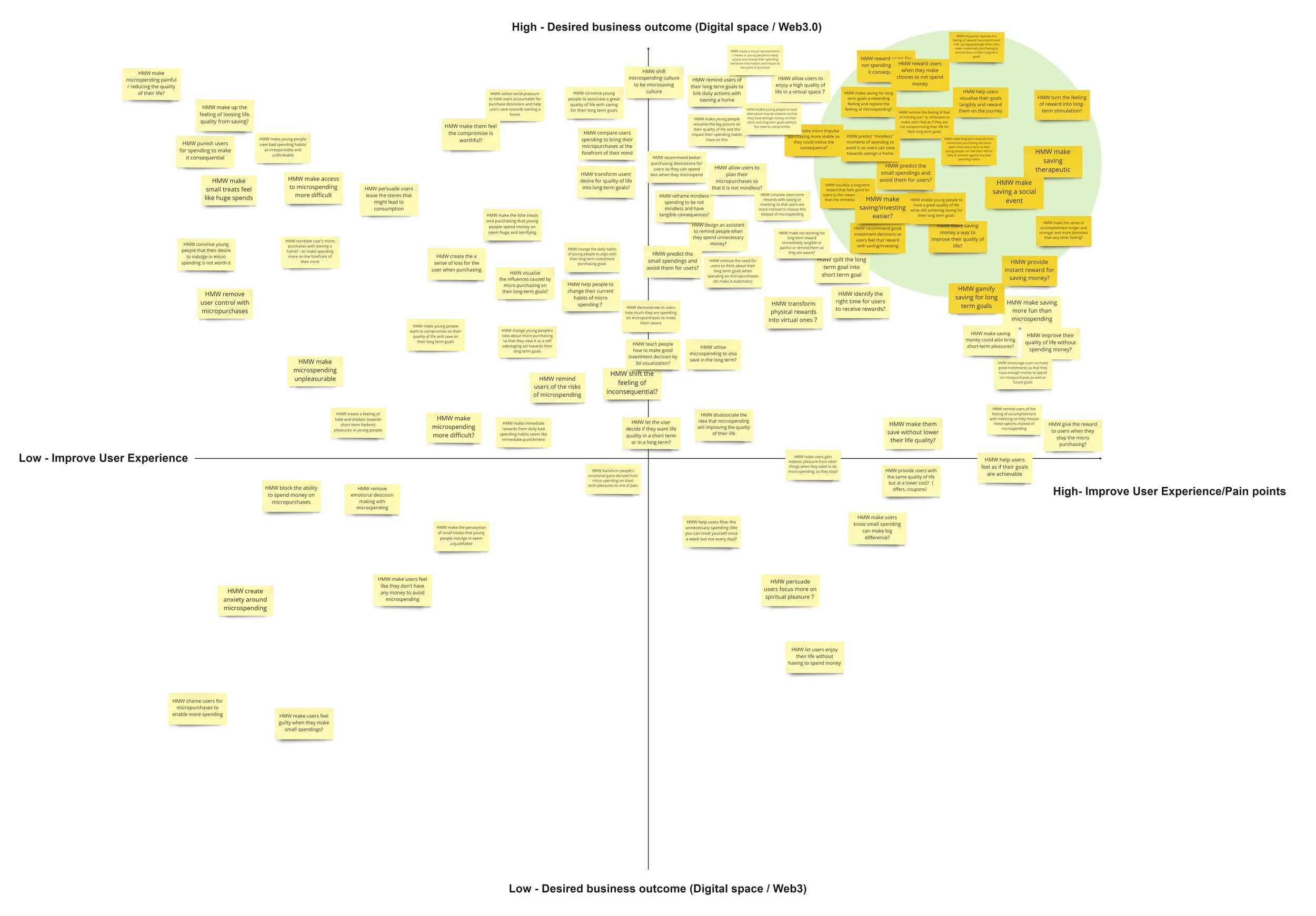

Do not want to compromise their quality of life.HOW MIGHT WE:

Make long-term rewards seem more short-term so that users can feel their efforts daily to minimise impulse spending.Predict and avoid "mindless" moments of spending so users can instead save towards owning a home.Help users visualise their goals tangibly and reward them on the journey.Make the consequence of micro impulse purchasing more salient.Make saving a social event so users can enjoy being social whilst working towards their long-term goals.IDEATION

We individually created ideas using Crazy 8 method, of which related ideas and insights were clustered. The top idea was evaluated with pros and cons keeping in mind a design for our final persona

INITIAL CONCEPTS

The two initial concepts were ‘virtual villages’, building and furnishing your own house in the metaverse and a mixed reality financial assistant. The pros and cons of these two revealed the first one can provide a more engaging and immersive experience, which will increase users long term engagement.

1

Chose as the main concept

Kept AI feature

2

PERSONA

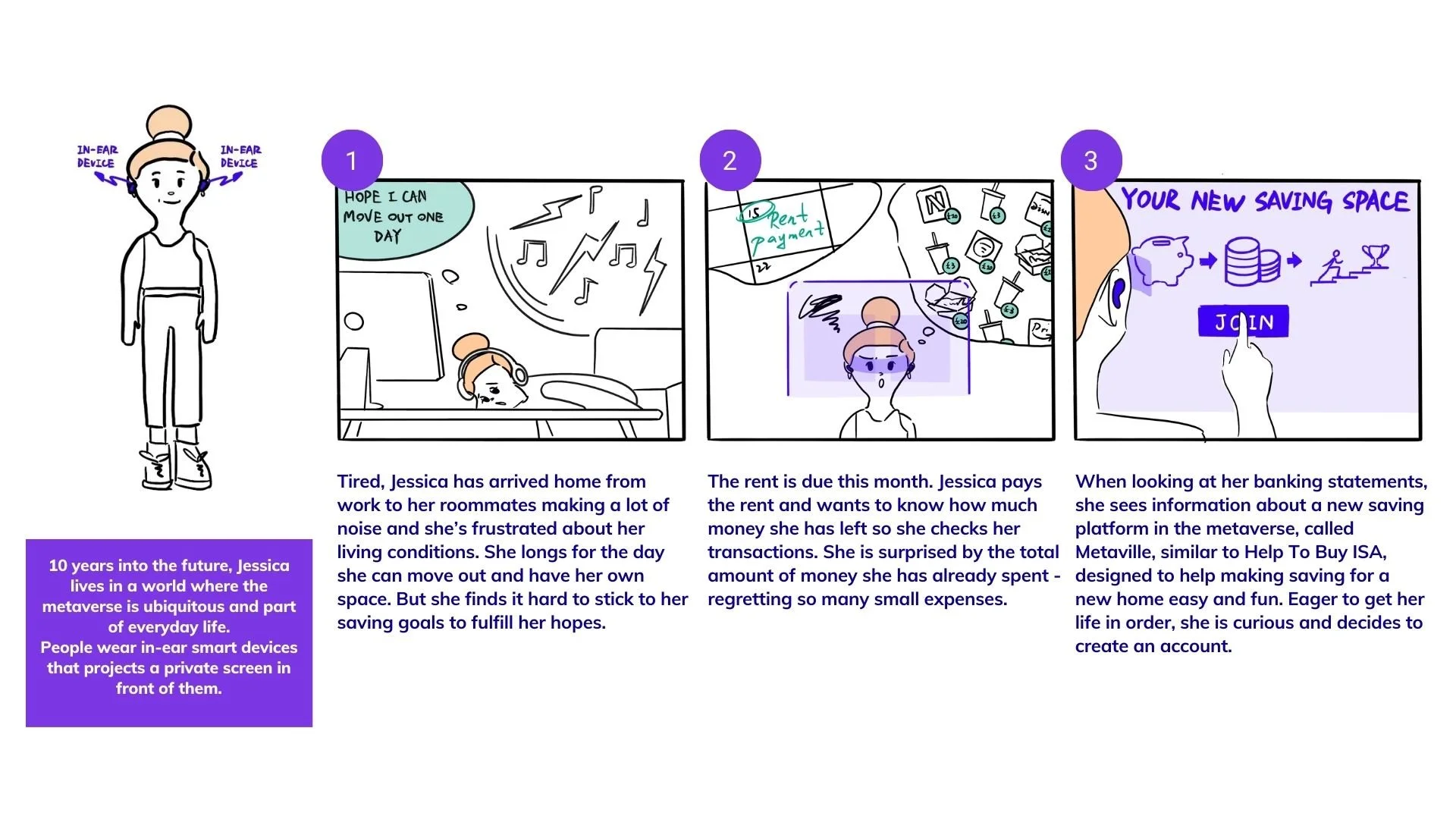

Our product is for someone like Jessica - a young professional, living in shared accommodation who longs to own their own space, travel, who might want to get into investments but doesn't know too much. But the rising costs of living and the hustle and bustle of life means they inadvertently end up spend a lot for convenience, subscription costs, and bills.

Persona of target user groupUX VISION STATEMENT

The virtual "village" space in the metaverse, is for young professionals in the first few years of their career, who want to own a first home but struggle with micro impulse purchases and never start putting their goals into practice, by providing an engaging, rewarding and personalized virtual saving space that uses shopping behaviour data and personal finance history, users will be supported towards buying their first home.

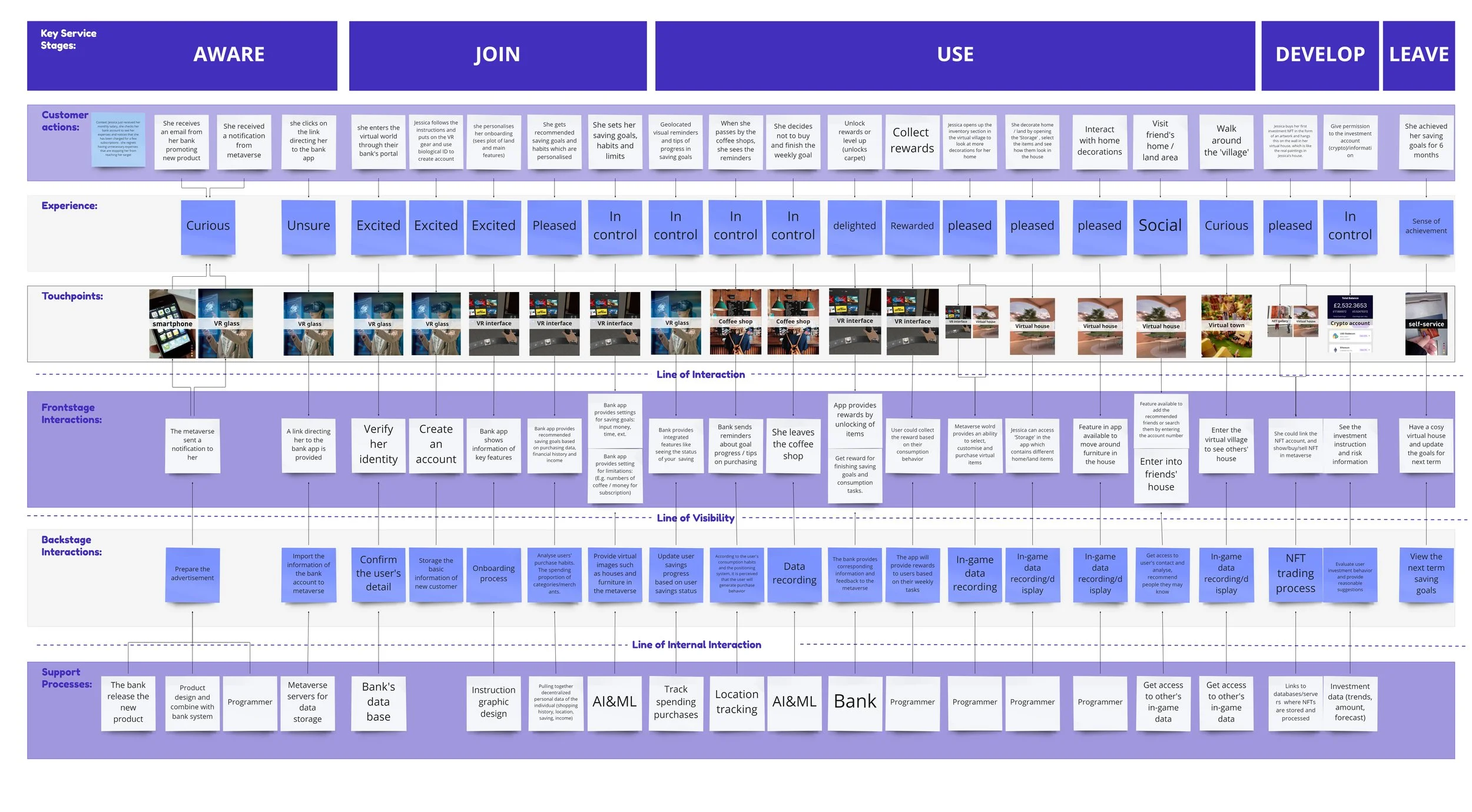

SERVICE BLUEPRINT

Service blueprint helped us in mapping out all the steps for using this service, covering all the features and processes. We also found opportunities to refine our concept.

INITIAL PROTOTYPE

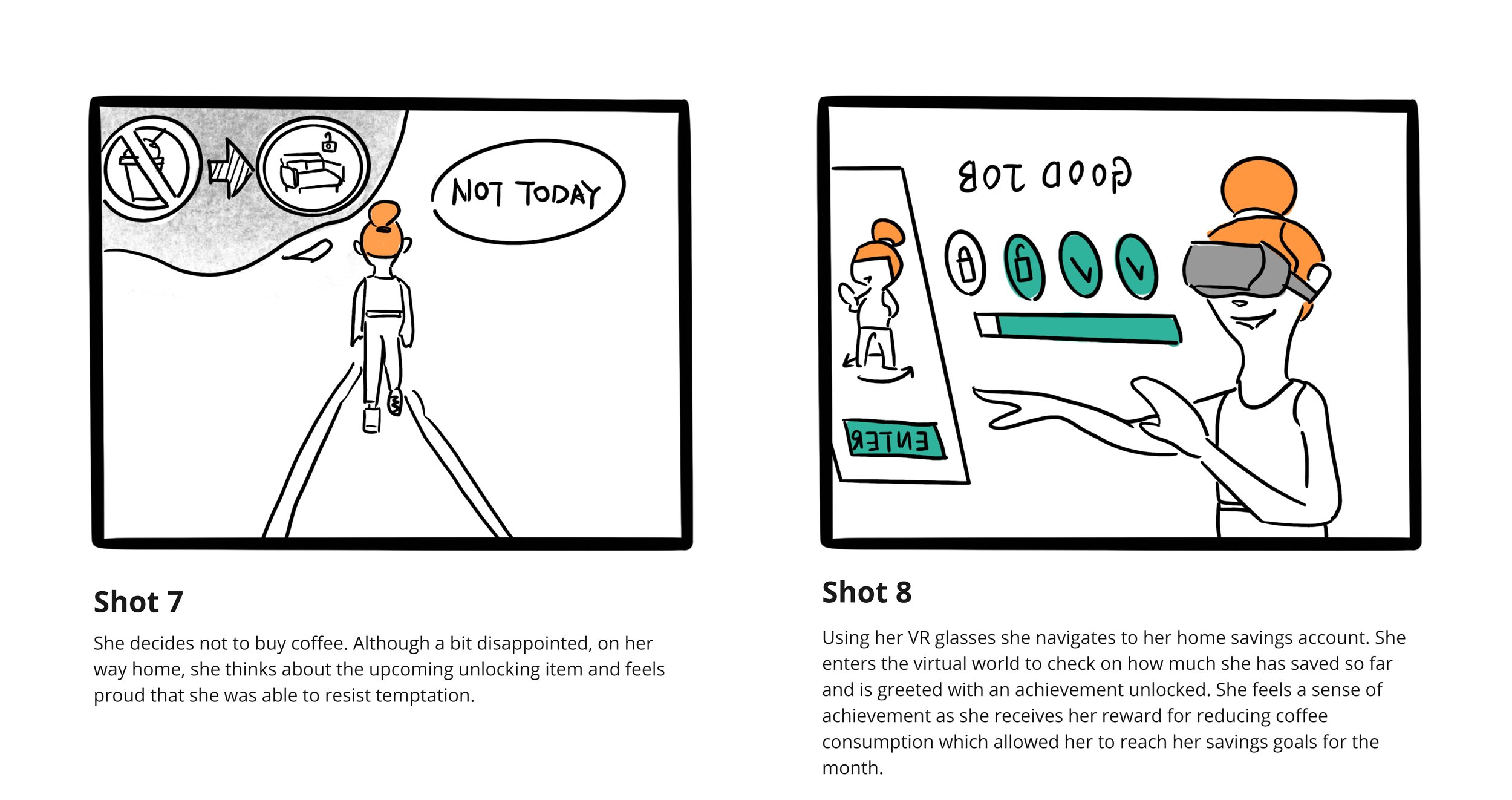

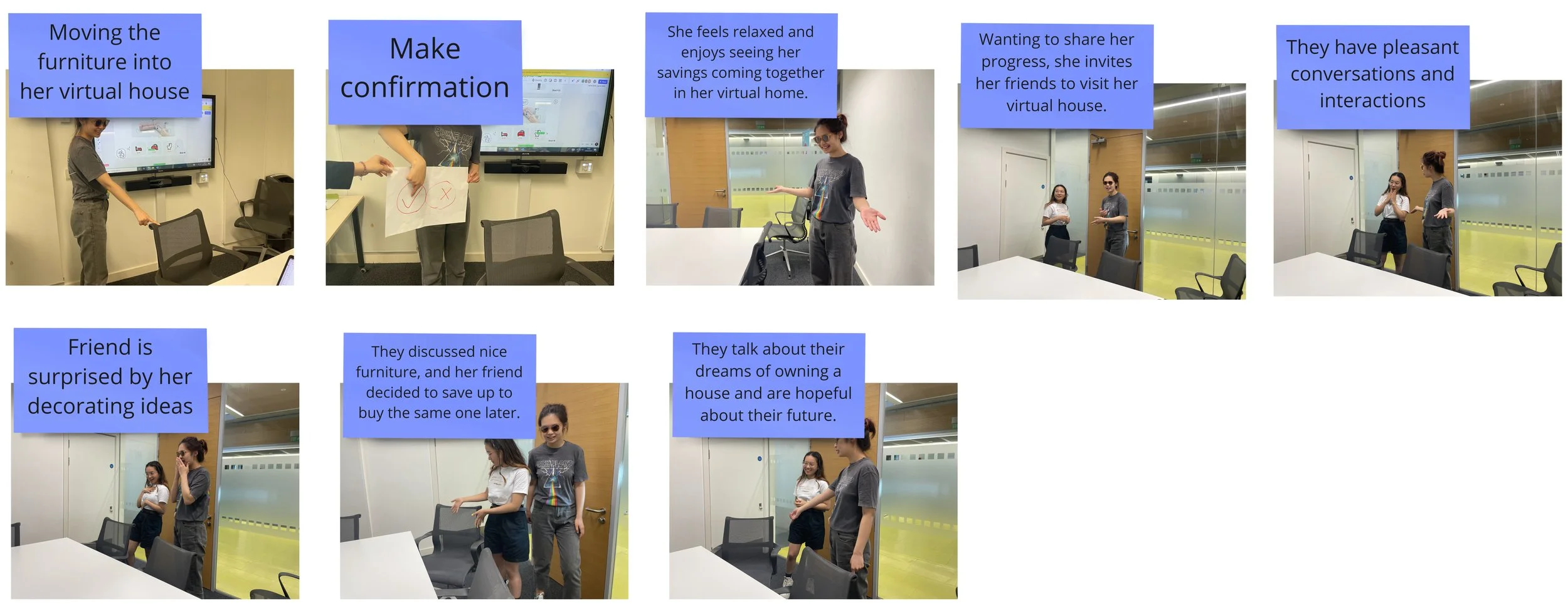

We visualized our concept in the form of a storyboard covering only the main features due to limited time on the project, this was then tested with our target users to get initial feedback.

FEEDBACK

“I can see myself using it but saving takes a while. I won't feel motivated if it takes too long”

Users could see themselves using the application - they responded well to the social features but the storyboard required clarity on the following:

Keep the duration of getting new rewards short so that the user can be active in the game. Record the specific spending per day, how much is spent on each item.Make users understand that the habit goals can be customised to personal needs (not just coffee)Users want something more portable than VR headsetBODY STORMING

We revised our prototype and made adjustments based on user feedback, we body stormed the new solution within ourselves to see if the motivation and action made sense.

We modified and tested again with our target user who responded well to our concept and would like a customised experience to help motivation.

Privacy like not allowing others to see their statements was also a concern integrated into the final product.

USER TASK FLOW

We specified each stage of the user interaction while they are using our product, this allowed us to define each potential outcome of the game process based on their interactions. click here to view task flow.

We also matched our key features to the insights and main pain points of our target users.

KEY FEATURES

1

Interactive savings visualisation

Personalised AI assistant

2

Reward achievements

3

Social interactions

4

BRANDING

I experimented with different possibilities for our brand logo while keeping in mind our product name and identity. The design was done using solid works to create a 3D outcome with a virtual feel and also represent a ‘home’. The highlighted concept was chosen.

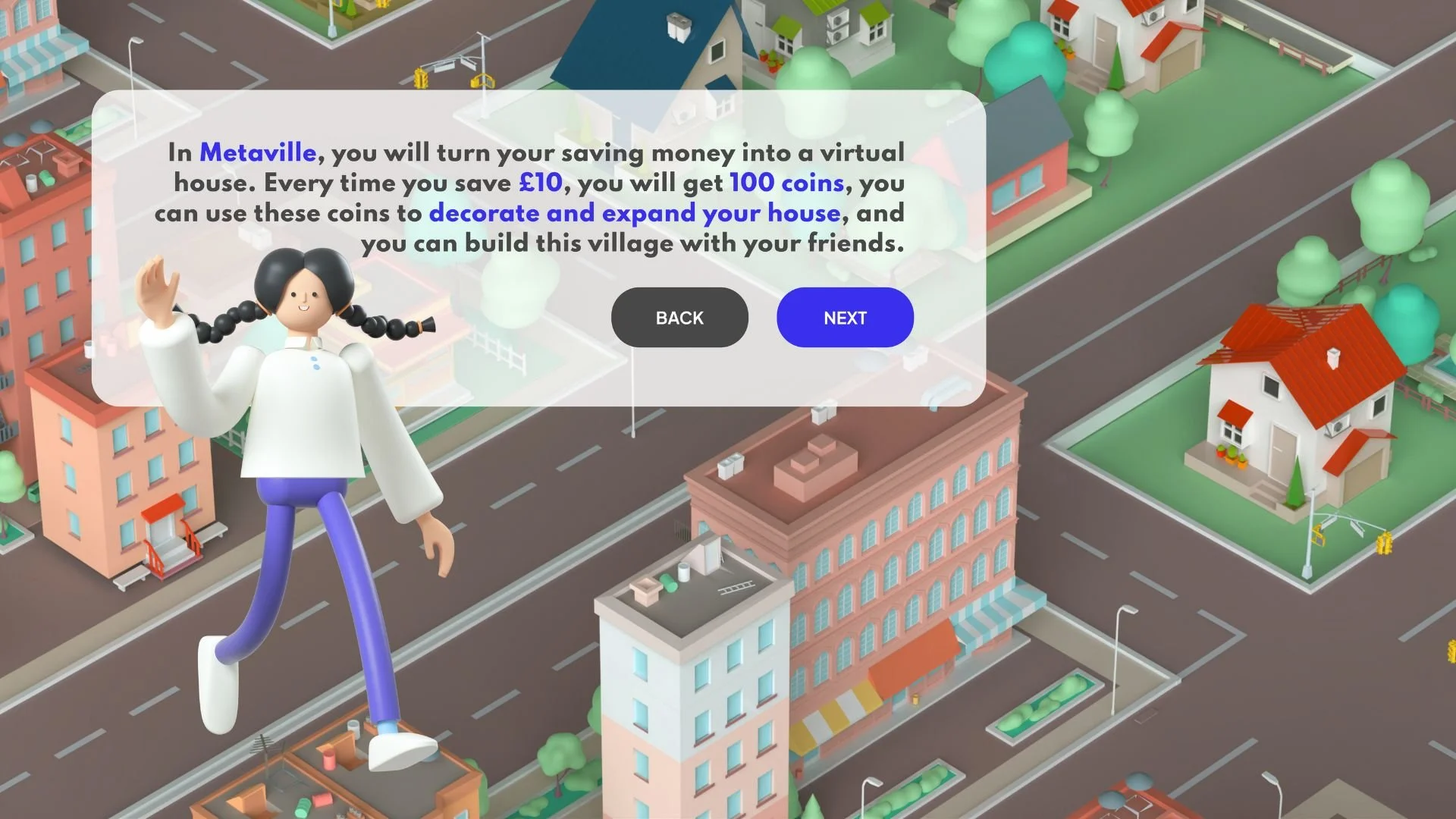

FINAL PROTOTYPE

STORYBOARD

We visualized our concept in the form of a storyboard covering only the main features due to limited time on the project, this was then tested with our target users to get initial feedback.

FINAL PROTOTYPE

ONBOARDING

After users join Metaville through the link from the bank, their bank accounts will be automatically linked. And when entering Metaville, a personal AI assistant which we called Mia will guide users through the entire process.

Next, the user will choose their ideal home type, such as flat, cottage, bungalow, etc, and then adjust the layout of their home. Then according to the user's choice and their historical financial situation, Mia will recommend a reasonable savings plan which they can adjust to suit their actual situation.

FINAL PROTOTYPE

AI RECOMMENDATIONS

When the user determines the saving plan, Mia will tell the user where they could have saved from the previous month, and provide the saving plan for the current month.

Mia will also provide optional rewards according to the amount of money saved, which can include virtual furniture.

Users can check the progress of their savings and when the monthly deposit is reached limit they will get valuable rewards such as 1 month membership for Spotify, or coffee shop coupons, etc. They can choose rewards according to their own preferences.

FINAL PROTOTYPE

PERSONAL AI ASSISTANT AND REWARDING BEHAVIOUR

In their daily life, when users have a tendency to engage in impulsive consumption behaviours, the smart device will pop up a reminder to inform the user that she is about to overspend on coffee this month.

If the user does not spend excessively and makes a reasonable deposit, the user will receive corresponding rewards.

FINAL PROTOTYPE

ITEMS PURCHASE AND HOME DECORATION

When the user deposits money into the account, virtual coins will be obtained. The user can use this to purchase decorations in the virtual shop to decorate and customize their rooms. These purchases will not consume the user's real deposit.

FINAL PROTOTYPE

SOCIAL EXPERIENCES

Users can interact with their friends online and invite them to be guests at their dream home in Metaville.

KEY VALUES FOR USERS

Less FMCG consumption

Users would be less to inclined to make impulse purchases on FMCG (coffee, fast fashion, etc).Valuable social interactions

Social interactions among users will involve discussions around financial health and growth.Increase in savings

Users can see their efforts of saving positively through an increase in finances overtime.Control and motivation

Supports users to control spending and rewards different levels of saving achievements.KEY VALUES FOR CAPCO

Opportunities for collaborations

Opportunities to collaborate with other businesses in sponsorships deals for Metaville.New customer groups

New users would subscribe to engage in this new and exciting experience of saving. More customer engagement

Immersive experiences means users involvement will be constant and sustained.Attract wider current user base

Metaville's potential for expansion to other saving goals means potential new users.FUTHER CONSIDERATIONS

FUTURE DEVELOPMENT

Metaville has various opportunities to develop its service to cater to different needs and provide further saving experiences for different potential users.

LEVERAGING MULTI-CULTURAL DIFFERENCES IN TEAM WORKING

INDIVIDUAL REFLECTION

My team had 5 female UX design students from MSc and MA programs, each from diverse ethnic and national backgrounds. We discussed roles informally at the beginning, covering the project structure, work preferences, and confidence in taking on tasks. This allowed us to assess everyone’s experiences and strengths, helping us plan an effective approach to meet our client’s needs.

We used the Belbin test (Belbin, 2022) to assess our behaviour in a team and my role was Shaper, when generating ideas in the group I tend to make sure we have looked at the whole picture and considered the pros and cons, so I am inclined to challenge every concept through asking questions. McGrath and Hollingshead (1994) stated that ‘different task types will have varying levels of uncertainty and equivocality.’

Our group successfully completed the design tasks, as confirmed by positive client feedback. In future team projects, I suggest we leverage our differences for maximum potential. Gruenfeld et al. (1996) state that "national diversity boosts team performance because multinational teams have a wider range of relevant knowledge." I've learned that it's important to recognize and embrace our differences, as this fosters better understanding and appreciation among team members. This approach leads to impressive outcomes in creativity and problem-solving by offering fresh perspectives, which increases the chances of finding innovative and effective solutions that connect with our target users.